Marketing for Financial Advisors by the Numbers

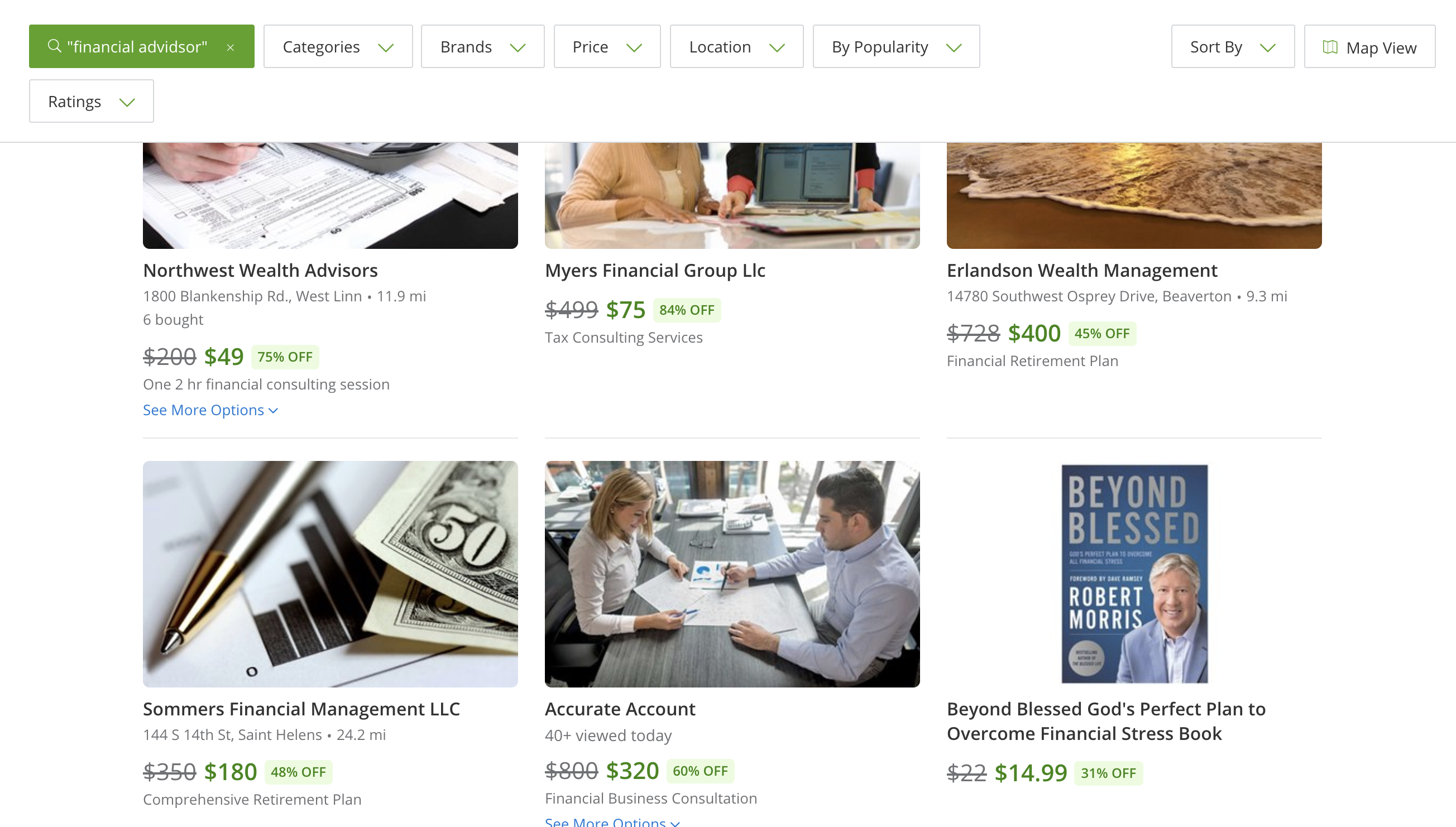

Back around 2011, small businesses across America were flocking to promote themselves on “deal” sites like Living Social and Groupon in order to bring in new business. The ‘deal’ given was typically offered to customers at 50% off of the retail price.

And before you say “but Financial Advisors don’t use Groupon to build their business,” just have a look at this screenshot of a quick search I just completed (and this is limited in my local area):

According to news reports, “deal” sites work remarkably well for consumers looking for a sweet deal… but not so much for the businesses looking to convert one-time purchases into long-term relationships. After getting the influx of new customers, businesses owners surveyed did not feel that starting a “deal” partnership with these companies was good for their business in long term.

The critical point here is not whether these “deal” sites work or not… or eve if they work for Advisors. Rather, the issue to consider here is the importance of knowing your business’ numbers well enough to decide whether or not to engage in a particular promotion.

The recent controversy with ‘deal’ sites highlighted the fact that you really can have too much of a good thing, if you don’t use the right numbers to make your decision. Most businesses promoting through “deal” sites or similar extreme discount offers don’t take the time to pencil out how to do it most effectively.

There are three important sales numbers for every business to know well before any kind of discounting can be done effectively:

- How many prospects are generated by the business’s advertising dollar(s)

- What is the percentage of customers converted from prospects

- How much does each customer spend with the business on average

Without an active focus on these numbers a business can engage in costly advertising and promotional programs, without seeing growth in their long term profits.

Traditionally, advertisers and marketers focus solely on #1, assuming that the way to get more profits is to spend more money on prospects. (In the case of running a “deal” this additional spending comes in the form of a willingness to take less revenue and profit on every sale).

Before any focus on spending more resources on advertising, a business owner should measure and look first at their conversion percentage (#2 above), and ask some questions of both themselves and their staff:

- Of the prospects who visit our business or website, is there something that we are doing to turn them away? Is there something more we can do to get them to buy?

- Are there common reasons as to why they don’t buy from us, once they have chosen to visit us? Are we carrying the right products and services? Are we offering the right features for our location?

Now if these examples don’t resonate with you, consider a common marketing approach for Financial Advisors: the “seminar.” How do you know if seminar marketing is a good investment for your practice? The answer lies in the numbers.

Most Advisors look at seminars as an expense, rather than an investment that generates a calculated return

Let’s say, for example, that mail out ten thousand invitations to your seminar. From that invitation, you generate 90 responses of which 76 people show up. Several of them are couples, representing 43 households. From the seminar, you schedule 11 appointments (but 4 cancel or don’t show up). Of the remaining 7 appointments, you convert 3 of them into new clients.

Was the seminar worth it?

We don’t know yet… because we have’t looked at the most important numbers: the money.

Let’s say the mailers, space rental, and food at the event came to a total of $8,500.

Let’s also say that your average new client has $284,000 to invest and that you earn a 1.5% commission, earning you $4,260 per client. With 3 new clients from your seminar, you’ve earned a total of $12,780 or a 50% profit over your investment.

A 50% profit is nothing to sneeze at. Of course, 100%, 200%, or even 300% would be better, right.

All of these COULD be possible, but knowing how to achieve them requires that you know your numbers.

The great business and marketing consultant, Jay Abraham, has often noted there are three basic pillars of increasing revenue:

- Get more clients

- Increase the average value of each client

- Sell high-ticket items

To these three, I’d add a forth: increase you sales conversion rate.

But doing any of these things effectively still requires that you know your numbers.

And achieving any of them requires a clearly defined, repeatable system that allows you to track and measure success.

One such system for Financial Advisors is our CORE4MULA program (briefly outlined in this video) which is built around optimizing your opportunities to extract maximum revenues from each of your marketing efforts.